As China enters the year of the tiger – a symbol of strength and bravery – GOLD journeys to this powerhouse nation to explore how it has become the second largest pharmaceutical market in the world

Words by Cheyenne Eugene

The recent dawning of Lunar New Year has welcomed hope for prosperity, wealth and happiness across many east Asian nations and beyond. The festive period begins with the first new moon of the ancient lunar calendar – a symbol associated with new beginnings, setting intentions and launching new projects.

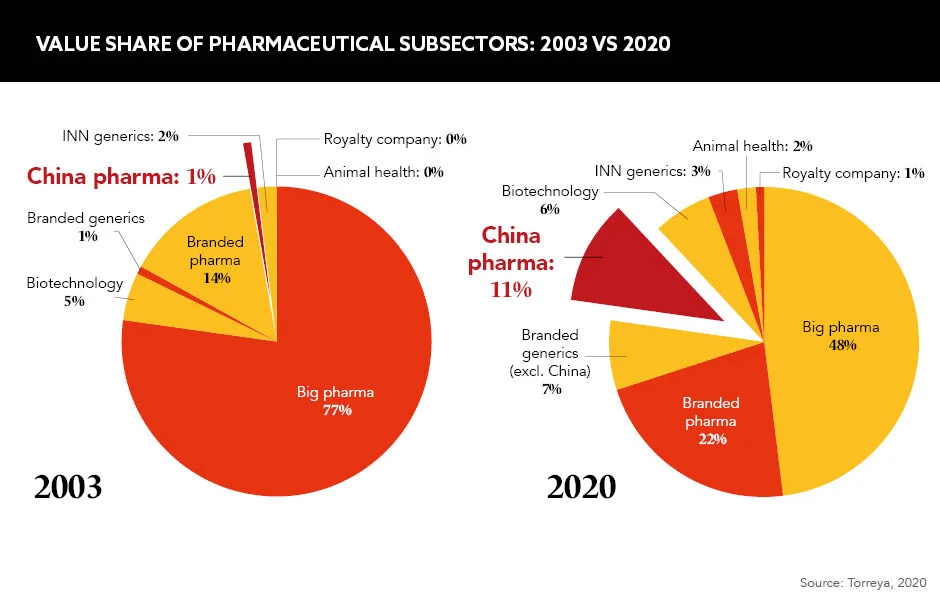

This sentiment is also coming into orbit for the global pharmaceutical industry, which is witnessing China’s shifting role and desire to find their place within it. “China has a vibrant dynamic, is fast-moving and is making great progress with a lasting impact,” explains Isabel Afonso, General Manager, Novartis Oncology China. The consensus is that China’s evolving position is due to a fusion of rapid regulatory reforms and better investment and reimbursement opportunities. These measures have led to the birth of a pro-innovation environment and widening market access that will reap huge benefits for the pharma industry and patients worldwide.

Regulatory reforms

Rapid regulatory reform at an unprecedented speed and scale has cultivated a fertile climate for innovation and supported faster development and approvals. In 2015, China undertook a policy overhaul that aimed to bring the country’s pharma regulations in line with international standards. Among these was the introduction of priority reviews by China’s National Medical Products Administration in 2016, which streamlined drug approval procedures. In addition, China officially joined the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use in 2017, marking a key milestone in the country’s integration into the international drug regulatory system.

Investment and reimbursement

Other seeds being sown in China’s flourishing pharma landscape include investment incentives. “We have witnessed a huge level of investment in innovative drugs, oncology, cell and gene therapies and biosimilar manufacturing over the last five years,” explains Francis Vaillant, General Manager, Sandoz Greater China. “We are also seeing an acceleration of local vaccines R&D investment following the COVID-19 pandemic,” he says. Ample capital for innovation reflects a growing confidence in the thriving Chinese biopharma space.

China has also become a global competitor in terms of pricing and reimbursement. Afonso tells GOLD: “Innovative approaches and measures have been implemented to enhance patient accessibility and affordability to innovative drugs, including increased frequency of negotiation with China’s National Reimbursement Drug List (NRDL).” Previously at a standstill, the NRDL has now been updated and expanded annually since 2017, meaning more innovative drugs are included and can receive a 70-80% coverage by insurance programmes. This, in turn, lowers the price of products and promotes accessibility, while simultaneously making China a lucrative destination for international pharmaceutical companies to establish partnerships.

Challenge and opportunity

Alongside increased government backing, China’s shift from ember to flame arises from its own national challenges: an aging demographic and intensifying prevalence of cancers, rare diseases and diabetes, to name a few. There are “huge unmet needs”, according to Afonso. “China has created the world’s second largest biopharma market, yet we still see enormous pent-up and unmet demand,” she says. The Chinese government has introduced two initiatives, ‘Made in China 2025’ and ‘Healthy China 2030’, which combine to make the nation a formidable global competitor by offering financial incentives to develop drugs for the Chinese market and the rest of the world.

When seeking untapped markets, multinational corporations (MNCs) should look further than the big cities of Beijing and Shanghai. “One of China’s pharma industry’s main challenges is to find a way to provide drug access and medical education to HCPs in the lower-tier cities [those with a population of between 200,000 and three million] in China,” explains Vaillant. “Lower-tier cities are where the main untapped growth resides in China and so far, few MNCs have been able to crack the code and find enough resources to penetrate this segment.”

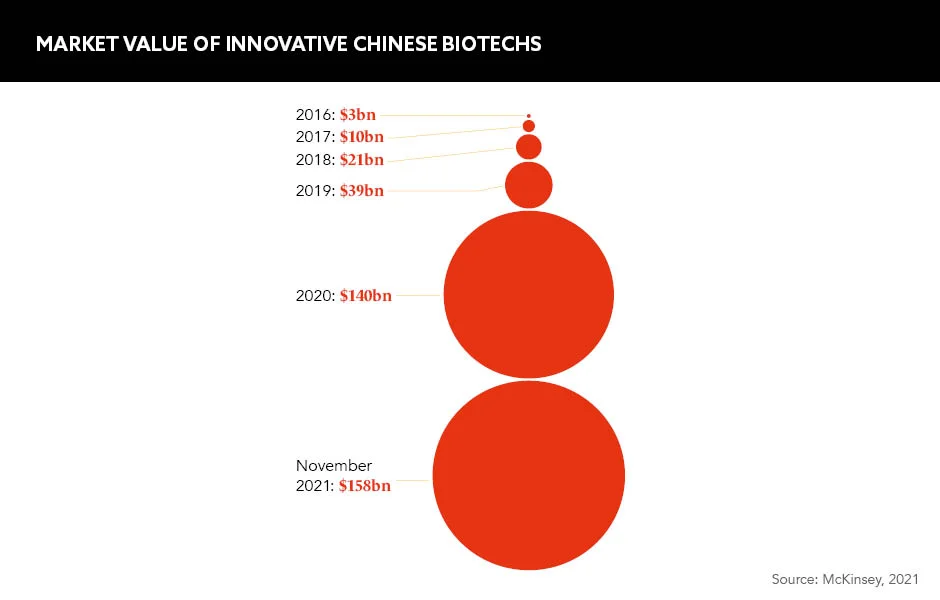

Further room for multinational partnership lies in China’s emerging biotech sector. “A whopping 140-plus new local biotech companies have arisen, materialised and surfaced in China from 2010 to 2020 — 70% of those recently listed [as] focusing on oncology,” Afonso tells GOLD. “This has opened opportunities for cross-border licensing deals between MNCs and Chinese pharma companies to expand access to medicines on a global scale.”

China’s newly-forged infrastructure is supporting a biotechnology surge that is expected to foster the nation’s emergence as a leading provider in certain subsegments. Although China’s biotech industry is relatively nascent, and opportunities toe the line between risk and reward, huge multinational deals have already been made, with companies like Novartis and AbbVie leading the way.

Historically, China’s pharma industry has been restricted by lengthy regulatory processes and lacking financial incentive for multinational companies looking to explore new and innovative opportunities. But, as Vaillant states, change is underway. “The pharma market in China is too big to ignore for pharma companies. As MNCs see the growth plateauing in North America and Europe, China is offering significant growth opportunities,” he concludes.

As the rest of the world finds its place within China’s ascent, the nation is harmonising with global standards and heading for a spectacular eclipse as it strives to become front and centre of the global pharma industry.