With investment in artificial intelligence on the rise across the pharmaceutical industry, we look at how AI tools can boost traditional marketing campaigns’ productivity, improve targeting, and deliver significant business value.

Words by Danny Buckland

Random forests, white box, intelligent humans, regression, and hyperplanes; alien concepts to an untrained mind but approaching forces in the pharmaceutical space that have the potential to energise sales and marketing campaigns. Machine learning and AI have clear indications in diagnostics and drug development; now however, they are offering novel opportunities to improve return-on-investment (ROI) and patient outcomes.

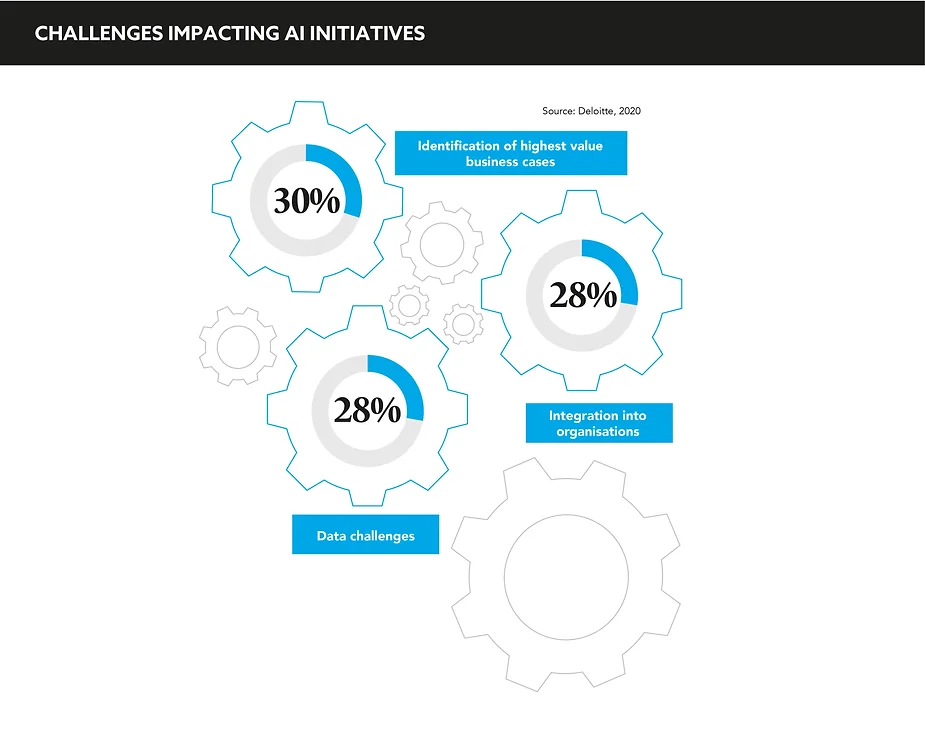

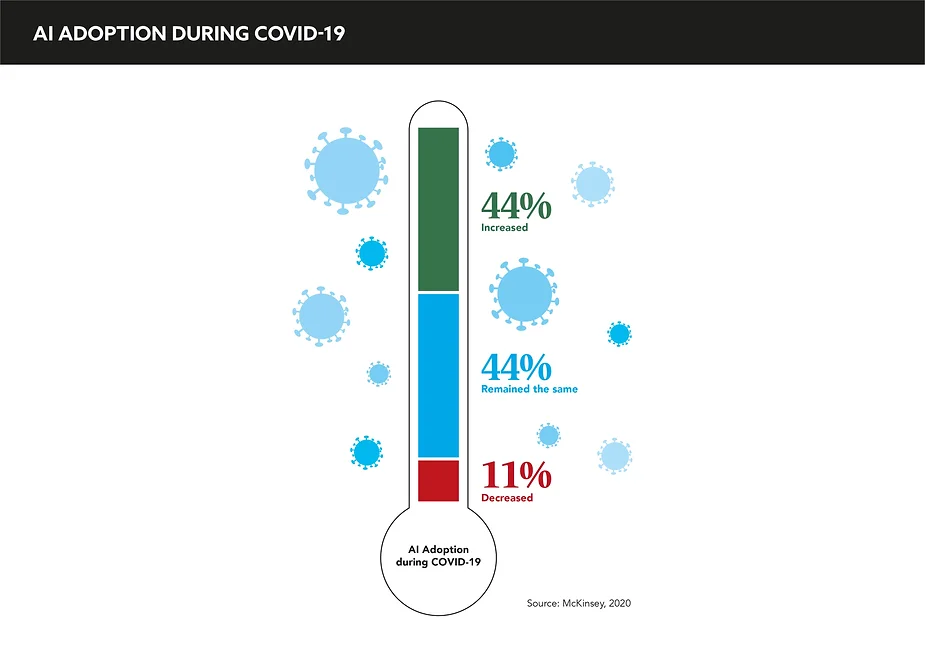

Traditional routes to engagement and sales are already influenced by digital capabilities but a new wave of cyber techniques can harness the raging ocean of data that washes through pharma and healthcare. Reports from GlobalData, a leading data and analytics company, forecast that the disruptive force of AI will deliver productivity gains across all aspects of the value chain in the coming years. The challenge is to embrace its potential to offset the mounting budgetary pressure from drug development and traditional marketing campaigns.

Pharma can perhaps not harness the same agility as the social networking services Instagram and TikToK, yet it can learn from the platforms’ digital mastery of hooking an audience, as well as from the strategies of Amazon and Facebook – both now substantial forces in healthcare – to get a deep understanding of both clinician and patient preferences and aversions.

The rewards are clear but achieving them goes way beyond purchasing software and hiring a team of data scientists. A fundamental shift is needed to bolt AI into the wider business ecosystem. “Something I see repeatedly in pharma is a classic disconnect of data scientists not being business strategists who, in turn, don’t understand data science. It is a challenge that is holding some pharma companies back because they choose the tech before they have identified the business challenge, when it should be the other way around,” says Dr Andree Bates, Founder and CEO, Eularis, a leading supplier of marketing analytics. “We need to get them speaking the same language.” Miscommunication has already derailed partnerships between pharma and data science organisations. “One big pharma company hired IBM Watson for data insight but it didn’t work because they didn’t understand what each other wanted. This is repeated across the industry and is wasting opportunity and budget,” says Bates.

The potential is enormous and there is a huge range of digital tools that are yet to be fully exploited

Eularis has a vast tech toolbox to connect patient, clinician, and pharma rapidly. In one project, it collated the facial characteristics associated with a rare disease and deployed facial recognition software to crawl online sites, such as Facebook and Flickr, to identify patients and trigger adverts when they searched disease-specific information. The operation identified 13 new patients who accessed the treatment they needed and lead to a significant ROI. “The potential is enormous and there is a huge range of digital tools that are yet to be fully exploited,” adds Bates, who has lead AI-powered programmes for top-tier industry companies across medical affairs, sales, and marketing.

Research by technology analytics company ZS highlights pharma’s ad hoc approach to its data mountains which, although mainly unstructured, contain gold mines of intelligence on how patient behaviour nuances influences affinity and switching.

Roxanne Balfe, Senior Digital Healthcare Analyst, GlobalData, believes pharma has realised the competitive edge available from deploying algorithms, machine learning, and strategic software to illuminate fresh insights: “Pharma has not been the swiftest sector to take advantage but that is changing,” she says. “There is a growing trend for pharma companies to partner with smaller companies that are experts in digital innovation and technology rather than acquire them or grow them from within. This shows that pharma companies are aware they must learn from the technology industry and forge partnerships to deliver innovation, otherwise they will lose out to companies in the tech and retail space that have a strong online presence and dedicated customer base.”

Security, privacy, and regulatory concerns are all issues but social media is also opening new landscapes for marketing. “Many influencers and users have gained popularity by sharing their healthcare experiences throughout the pandemic, opening up opportunities for pharma and healthcare to take advantage of the technology,” adds Balfe. “These opportunities include insight mining: searching the platform for content related to a brand, disease state, or patient communities. Many influencers and patients have posted throughout 2020, either relating to healthcare experiences or specific conditions and diagnoses. Collaborating with healthcare professional influencers is especially relevant for younger audiences.”

The human touch in sales and marketing is still critical but AI and machine learning are set to be a growing thicket within the pharma landscape.