Words by James Coker

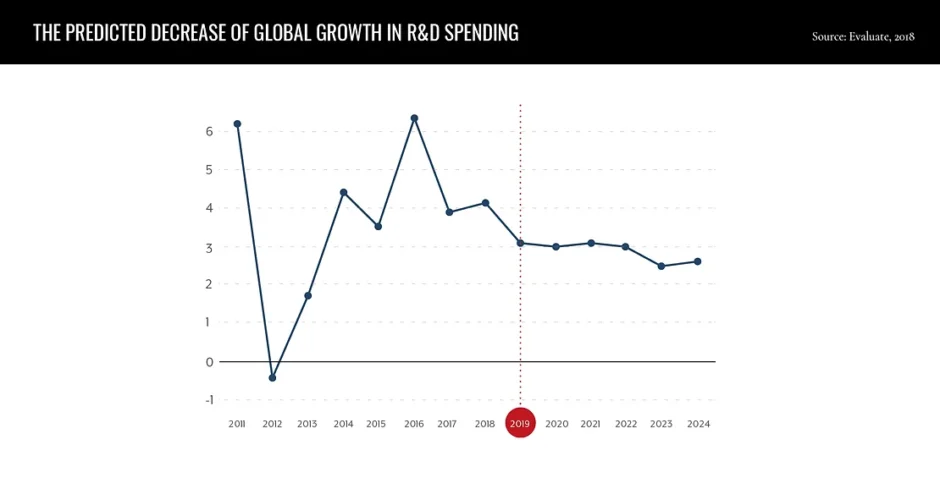

Arresting the decline in R&D productivity levels is rapidly becoming one of the biggest challenges for the pharmaceutical industry. Figures, such as those from Deloitte showing that ROI has shrunk from 10.1% in 2010 to 1.9% in 2018, emphasise the urgency of reviewing existing operational methods.

As starkly outlined by Colin Terry, Life Sciences and Healthcare Director, Deloitte: “There is an understanding that the innovation within the four walls is not working and people are having to look for different ways of doing things.” Pharma are taking a dual approach to shifting their outlook, both reorganising their internal dynamics and turning to external sources of innovation.

ROI has shrunk from 10.1% in 2010 to 1.9% in 2018

Devolving power to smaller groups that operate outside of a company’s normal centralised framework is a good starting point in creating an environment that breeds innovation. As well as the greater flexibility and fluidity this allows, it can be a driver for more intense focus and thus faster results. “You have to make it somewhat difficult to access bigger resources, and that sort of resource constraint, whether it’s time, money, or bench space, does tend to make people a little bit hungrier”, says Terry during the 2018 FT Global Pharmaceutical and Biotechnology Conference.

Pharma have also been refining their focus in recent times: prioritising those areas in which they are especially strong. Last year, for instance, Novartis reduced about 20% of its research portfolio to boost efficiency.

Alongside restructuring the workforce comes restructuring mindsets. Having the intention to deliver quick breakthroughs is something that Ken Gabriel, President and CEO, Draper Labs, believes in passionately. “I don’t think it should take 8, 10, 15 years of writing some technology curve, which is driven by a conventional world view of what’s going to happen. If something like CAR T-cell therapy is fundamentally changing this industry, and I believe it will, then it takes new bold innovative breakthrough approaches to how you manufacture this therapy, not what the old way of doing it was”, he argues. Gabriel believes that fixed budgets and timeframes are necessary to create this mindset.

And what of the individuals working on these new breakthrough therapies? Moving to this kind of entrepreneurial structure also means employees should be correspondingly incentivised in ways that encourage rapid breakthroughs. This includes rewarding truth-seeking behaviour, even if the results show that a project is failing, as that at least allows time and resources to be moved elsewhere rapidly.

This type of targeted rewards structure is still lacking effective implementation within the pharma industry. “I’ve seen a number of pharma companies try and come up with more entrepreneurial structures but then they set up the incentives and also the decision-making in such a way that you don’t get the entrepreneurial environment”, says Daphne Zohar, CEO, PureTech Health.

Drawing expertise from other organisations is also becoming an increasingly prominent strategy for pharma. There is a growing realisation that in order to find solutions to the biggest challenges in healthcare, such as neurodegenerative diseases and antimicrobial resistance, knowledge and expertise must be pooled from a variety of sources.

“I think the system outside pharma with the binary attrition model in the smaller companies and biotech start-ups are now well trained in providing us with that innovation and we can’t keep up with that in pharma; the best innovation is often much more likely to happen elsewhere”, states Thomas Eichholtz, Executive Director External R&D, Mundipharma Research.

The advent of non-traditional players in the life-sciences sector adds an extra element of intrigue. Tech companies such as Apple and Google see healthcare as a major marketplace for their innovative technological solutions and these new kids on the block have certain advantages over pharma in terms of their expertise, operational fluidity, and financial resources.

“We’re beginning to reap the benefits of technology-driven healthcare, but they’re not being picked up in many cases by pharma companies, they’re picked up by companies they deal with later when gaining information on potential patients. If we’re missing out on that we run the risk of becoming obsolete. I believe those who are smart will move to partnerships with non-traditional partners”, adds Eichholtz.

We’re beginning to reap the benefits of technology-driven healthcare, but they’re not being picked up in many cases by pharma companies

Pharma needs to update its practices and organisational structure to improve productivity levels in R&D. Ultimately, the companies best able to rapidly adapt to a changing and more competitive environment will be those that prosper.