From the tip of Big Ben to the depths of Cheddar Gorge, the UK has a varied landscape both in geography and business. In 2021, it was even named the sixth biggest pharmaceutical market, but it’s facing challenges to further growth

Words by Jade Williams

The UK life sciences sector, like many others, has experienced its fair share of challenges in recent years. Events such as Brexit, COVID-19 and the Voluntary Scheme for Branded Medicines Pricing and Access (VPAS) have led to a difficult chapter for pharmaceutical companies operating in the UK, however, there has been hope for the sector in tandem.

“The life sciences sector is one of the highest value-generating sectors in the UK,” notes a representative from the Association of the British Pharmaceutical Industry (ABPI). “Pharmaceutical manufacturing generated 1.25 times the economic value of the UK automotive sector and around 2.4 times that of the UK aerospace and oil and gas industries in 2019.”

Despite the challenges at the national and manufacturer levels, the UK remains an attractive location for companies looking to set up new laboratories and develop innovative medicines. “The UK is a world leader in early-stage research, particularly in basic science and the discovery of new drugs and vaccines,” adds the ABPI representative. The UK is focused on driving new scientific discoveries and health initiatives, but to what end is it succeeding?

Innovative initiatives

The UK has a wide range of life sciences initiatives designed to help the nation both develop a stronger foothold in the global pharma industry and create world-class treatments for patients. Initiatives such as the UK Biobank, Genomics England and, most recently, Our Future Health, show investors that the UK is committed to driving innovation on its own shores. Speaking on this, Paul Jones, CEO, Vortex Biosciences, states that these large-scale programmes are interesting even for small businesses, as he believes that they “could be the proving ground for getting new and innovative types of technology adopted at a population level”. An example he raises is liquid biopsy, which can screen for early-stage cancers via a single blood test.

The life sciences sector is one of the highest value-generating sectors in the UK

These innovative initiatives, combined with the great minds sitting in organisations such as the London Cancer Hub and other scientific institutes, can also make the UK a tempting market for early-stage companies looking to draw the best minds into their businesses. The UK hopes to be not only a fertile ground for innovation, but a pool of talent as well.

On stable ground?

It would not be right to discuss the UK’s position as a global pharma power without acknowledging its mighty NHS. The UK’s National Health Service is world-renowned and has been supported since its inception by pharma companies supplying their products to the system.

The current state of the NHS is a challenge for the UK, the strains it faces in the wake of COVID-19 are severe, and the recent strikes and mass walkouts by junior doctors and nurses over pay disputes show that there is discontent at every level. “There’s no doubt that this national health system is under pressure at the moment,” notes Jones. “Sometimes when those systems are challenged, there’s a really interesting opportunity for pharma to use some of its resources to realign and support the system to be more effective.”

Rather than pushing a product into a system that may not have the infrastructure and resources to train individuals to deliver it, pharma could use the current climate as an opportunity to rethink how they sell drugs into the NHS for the benefit of public health in the nation. “I think the NHS crisis might make pharma think about a slightly different model, and I would encourage them to do so,” Jones continues. Companies need to consider how they can better adapt to the system into which they’re hoping to introduce new innovations.

With the massive amounts of fatigue currently being experienced by healthcare professionals within the UK healthcare system, combined with a landslide of backlogs in spaces such as oncology, there is certainly room for pharma to play a larger role in ensuring therapies can be administered in a time and cost efficient way in the UK. Indeed, Jones advocates for “pharma playing a key role by facilitating the translation of research efforts into clinical systems for the benefit of patients – this requires the simultaneous engagement of government, the NHS, academic research and industry”.

The VPAS rebate

The UK’s reputation for early-stage research and its wealth of scientific expertise are both attractions for pharmaceutical companies looking to enter the UK life sciences sector, but the outlook for new investment in the nation is not all roses either. Emma Chaffin, former Vice President, Country Head and Site Lead, Galapagos, comments: “The biggest challenge for any general manager in the pharmaceutical industry now is how to consolidate the VPAS rebate, particularly for this year, and how to think about what that might look like in the future.”

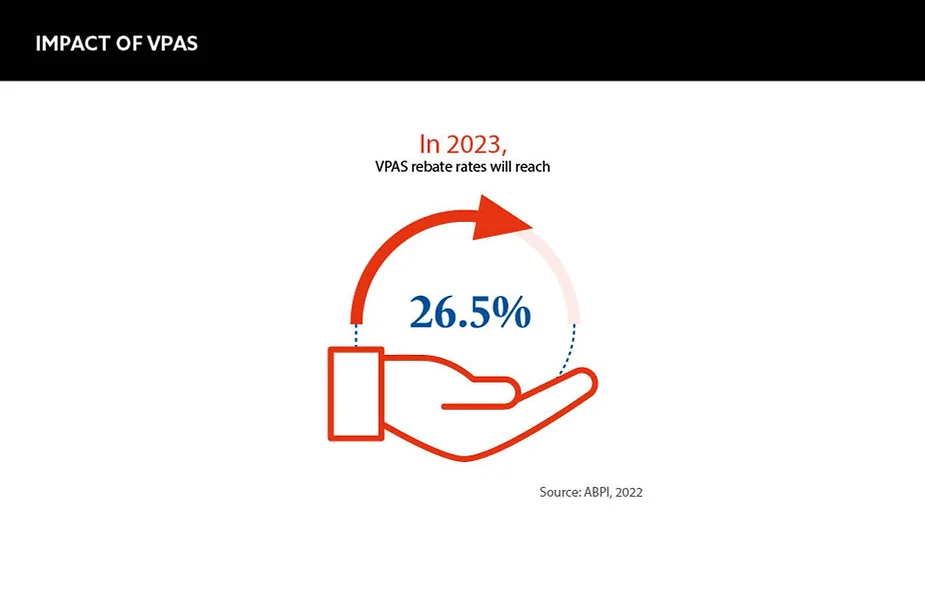

The VPAS came into effect in January 2019, and it was created to balance NHS spending on medicines while supporting innovation and the UK economy. However, in December 2022, the UK government announced that it would increase the VPAS clawback rate from 15% in 2022 to 26.5% in 2023. This is high compared with similar schemes in other countries. For example, the rates in Germany are 12%, in Ireland 9% and in Spain 7.5%. As a result, the increase has not been well received by the industry as a whole.

The rebate rates may be for effective for raising capital for UK economy, but there is a significant negative correlation between the reclaiming of funds and investment in pharmaceutical R&D. In fact, AbbVie and Eli Lilly both pulled out of the UK scheme in January this year following the announcement.

If people are walking away from the table, clearly something has gone wrong

“Competition for budgets internally is tough in any company, and it’s becoming increasingly challenging in the context of the rebate to justify why that budget and that investment should go to the UK with such a high level of return,” states Chaffin. International pharma companies have rarely leant away from the UK, but now having to justify investment against the rebate is proving a challenging task. Jones agrees, stating that “VPAS is not encouraging collaboration. If people are walking away from the table, clearly something has gone wrong”.

This is a point echoed by the ABPI spokesperson, who says: “The current VPAS has become unfit for purpose and should not be renewed in its current form when it concludes at the end of 2023.” If this scheme, while well-intentioned, is driving the pharma industry and its life-saving products out of the UK, can it really be that beneficial in its existing state?

For Jones, the best next step would be to adapt the scheme. “How could there be opportunities for more flexibility?” he asks. The world has changed dramatically since the birth of VPAS, and many companies believe that the rules of the game should change to reflect the need for a renewed outlook on pharma innovation.

Moving forward

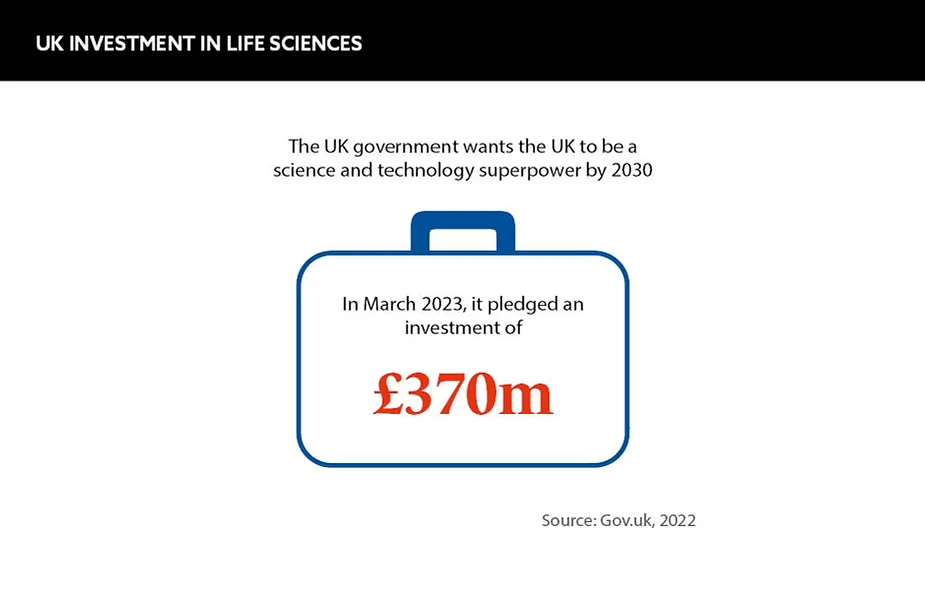

The road ahead for the UK’s life sciences sector is more fragmented than ever. Going forward, the ABPI representative argues that the nation needs to develop a far more attractive business environment for pharma through a variety of methods, including improved fiscal incentives, a stronger manufacturing and research infrastructure, better investment, access and uptake of innovative medicines and a renewed approach to priority health challenges.

It is evident that the UK pharma space has a level of uncertainty for investors in 2023. While the bailout of Silicon Valley Bank’s UK branch by HSBC in March 2023 may mean that the UK’s digital health space feels more secure, the rest of the sector can’t rest yet.