After years of tough negotiations, the UK has left the European Union. GOLD explores how pharmaceutical innovation has been affected as the UK works to replace EU resources and make use of its new-found regulatory freedom

Words by Isabel O’Brien

Brexit once dominated news headlines and conference agendas across Europe, but over the past 12 months, the subject has been understandably usurped by the pandemic.

While the crisis has been holding the media’s attention, industries in the UK, including pharma, have been adapting to new structures, pathways and protocols since the deal was done in January 2021. With both the public and private sectors keen to shield the life sciences sector from disruption.

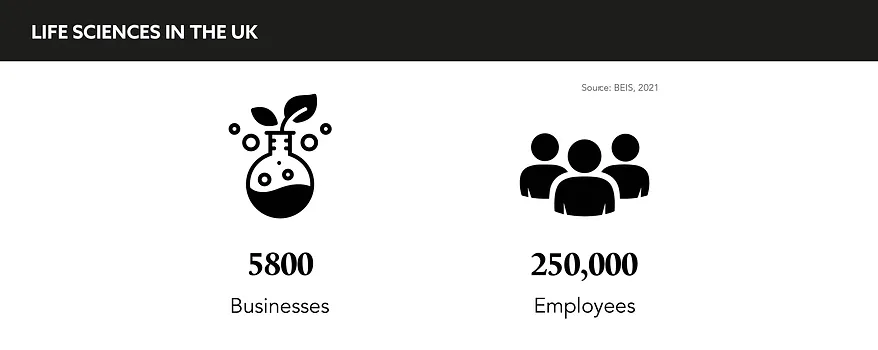

And there’s a reason why. Not only does the UK government need to keep medicines flowing and medical research going, but the nation’s pharmaceutical sector employs over a quarter of a million people and has an annual turnover of over £80bn.

A spokesperson for the Department for Business, Energy & Industrial Strategy (BEIS) describes the UK as “one of the world’s best research and science bases”, referencing its reputation for clinical research and an “unparalleled” cradle-to-grave healthcare system in the NHS.

As a result, agencies, companies and the UK government have been working hard to prevent shortages and lost productivity in the nation. But what challenges have they faced?

The EU and UK recognised that there would be disruption to medicinal products

Challenging times

A key challenge has been supply chain contingency, which has been a source of anxiety for the public, concerns that were only exacerbated by the onset of COVID-19.

In the short term, there has been a 500% increase in the number of drugs that have been temporarily unavailable. However, when it comes to the bigger picture, these shortages will, hopefully, be temporary.

This is addressed by Deborah Cooper, Director, PwC , who says: “The EU and UK recognised that there would be disruption to medicinal products.” But she reminds us that the trade agreement had one notable exception. “An annex to the deal established mutual recognition of inspections and good manufacturing practice, removing much of the duplicate regulation.”

Mutual recognition agreements facilitate the efficient trade of medicines by reducing costs for manufacturers, allowing fewer inspections of facilities and waiving retesting of products upon import. If successful, this would be a welcomed way curb current disruption and restore the flow to pre-Brexit levels.

Clinical trial recruitment in the UK has also undergone a structural transformation since the deal was done. While UK innovation hubs once utilised the databases of potential trial participants from across the EU, “Numerous research registries are no longer available,” explains Cooper.

However, it’s not all doom and gloom in her view. “Research and clinical trials have continued due to the ease of access to the NHS data sets and patient cohorts, and the collaborative approach of the MHRA and NICE in driving better clinical outcomes.” The two parties have worked in synergy to harness health data and support the continuation and success of clinical trials in the UK.

Another potential shortfall is funding into R&D. The UK and EU once shared resources in this realm; the UK was granted access to EU initiatives such as Horizon 2020 and the European Investment Fund, at one time, benefitting from 16% of the funding from one such initiative.

Losing access to these resources is an undeniable blow, but the UK government has pledged to make up the difference to ease the financial burden on developers.

The BEIS spokesperson comments: “We will use the regulatory freedoms gained by leaving the EU to grow the sector even further.” Citing a £200 million fund to boost innovation, they say this be part of the total £14.6 billion investment pledge that will be made between 2021–2022 by the UK government.

Clinical trials have continued due to the ease of access to the NHS data sets and patient cohorts

Hope for the future

While the UK is currently sitting in the top three life sciences hubs globally, the nation is hoping to also attract new investment following its EU departure.

“Brexit may result in the UK being able to make its R&D tax relief and tax credit schemes more generous without the caps dictated under EU law, ensuring that the UK businesses remain competitive in new markets, attract investment, and is comparable to other schemes such as Canada’s,” says Cooper.

These tax reliefs coupled with the funding boost could position the UK as an attractive location for multinationals to come and develop their drugs.

While Brexit may have been downgraded in public consciousness, behind the scenes the UK and the EU have been working hard to ensure that drug supply, clinical trials, and funding are not disrupted by the historic exit. As with any period of upheaval, challenges may lie ahead.

At present, priorities are positioned in a cohesive and positive direction, ensuring the continuation of innovation for the benefit of patients on both sides of the split.