The first-time launch landscape is growing. In an increasing number of cases, it’s emerging biopharma and biotech companies launching new drugs rather than established pharma giants leading the way. What has caused the tides to change, and how can emerging companies ensure first-time launch success?

Words by Jade Williams

The first tentative steps into open water can be nerve-racking for even the most experienced swimmer, but particularly so when it’s someone entering the ocean for the first time – as yet unknowing of the potentially bone-chilling temperatures set to engulf them.

While launching a new drug for the first time isn’t quite the same as submerging into a freezing body of water, it can conjure similar feelings of suspense and anxiety for what is to come. No matter the amount of planning that goes ahead of a first-time launch, questions always loom about what awaits in the depths.

Pushing the boat out

A multitude of new therapies are being brought to market as first-time launches from biopharmaceutical companies hoping to make their name in the industry. In fact, by 2025 the share of new launches from emerging biopharmas is expected to account for up to half of all novel endeavours.

Economic growth in the industry has been strong over the past five years, and as the volume of mergers and acquisitions has grown, so too has the financial muscle of small biopharmas. This increased revenue has led to a tidal wave of first-time launchers of pharma products from these firms.

A lot of what drives success and value starts very early in development

Money and tenacity do not, however, make a launch a sure-fire success. Ben Hohn, Principal of Business Development, Pipeline and Launch Strategy, and Emerging Pharma Lead, ZS Associates, notes: “A lot of what drives success and value starts very early in development. You want to start in earnest preparing for your launch typically 18-24 months beforehand.” He urges that it is important to not just think about how to get a drug approved but to plan how to generate evidence that will support its competitive profile.

To achieve national success with a first-time launch, Jennifer Cain Birkmose, Senior Principle, IQVIA, and Co-Founder, Viva Valet, Elderly Support Digital Platform, highlights one key ingredient: “Without access, you cannot have a meaningful commercial uptake and widespread patient benefit to your product.” She recommends that newer launchers either on-board or outsource medical scientific advisors to educate physicians about the disease area, the data and the product itself to create maximum access – in this way, their expertise is crucial.

Launching in tandem

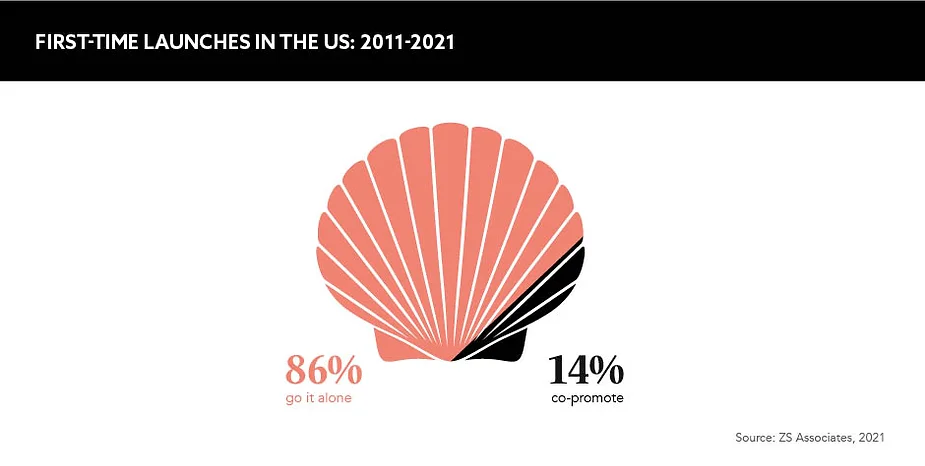

Another suggested route that can help first-time launchers to compete against their already established rivals is partnering with another organisation to co-promote the launch.

When pursuing a co-promotion, Cain Birkmose states that each half of the partnership must bring its own strengths to the launch in terms of product knowledge, patient engagement, supply chain excellence and more. “The advantage to this kind of partnership model is broader patient access across multiple markets and leveraging commercial synergies to increase geographic reach and raise peak sales performance,” she explains. Partners that have already mastered the unpredictable seas of drug launch can help emerging companies and their investors secure a greater chance of success, utilising their experience to guide the way to a healthy ROI.

Without access, you cannot have a meaningful commercial uptake

While these arrangements can certainly offer benefits to emerging biopharmas seeking to take the plunge into launch territory, there are downsides. “Co-promotes are often complicated,” states Hohn. “Decision-making takes three or four times as long as a single promotion project, and it can certainly be onerous.” However, he is also keen to note that several companies have enjoyed success through this method. For example, the Abbvie company Pharmacyclics entered a pre-launch worldwide collaboration with Janssen Biotech for the leukaemia drug Imbruvica in the US.

Beyond borders

Becoming a national success is one checkbox to be ticked, but expanding a product launch to international waters is often a top priority, too. Companies should look to expand their territories once a launch has succeeded in its local landscape, and, typically, the wider EU market is the first port of call.

Cain Birkmose advises companies to “utilise the centralised regulatory procedures of the European Medicines Agency to speed up time to marketing authorisation”, while at the same time remembering “patient and payer access is entirely a local market activity”. In order to navigate these nuances, it is crucial that companies create “localised dossiers, localised health economic and budget impact data, and often preferred comparators,” she adds.

Intrepid pioneers may seek to expand their launches further to Japan and China, however, Hohn notes, that “the distribution system favours those that are more established over new entrants”. An established track record is advantageous, which clearly acts as a blocker for first-time launchers in the region.

As a final thought on the first-time launch landscape, Hohn offers a warning: “Launchers tend to see things as separate pieces, and, in the better launches, you realise that a lot of these things are interconnected. Your payer strategy impacts your forecast, your valuation and potentially your clinical programme and evidence plan. You do need to do a fair amount in parallel rather than a step-by-step process.”

To ensure a launch does not end up dead in the water, first-time launchers should seek to coordinate their processes and connect the dots between approval, market access and commercial success. In this sink or swim environment, harmonisation is truly key.